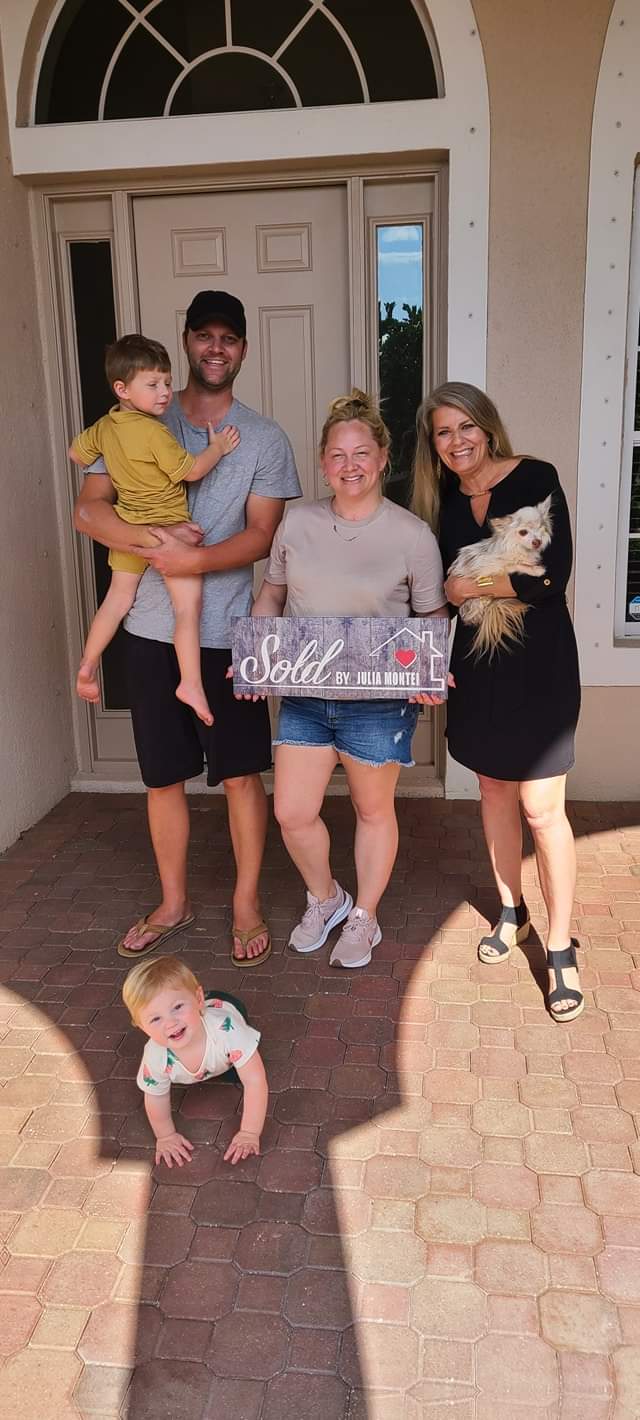

“We sold our home and had only a few short weeks to come across our dream home. Julia was absolutely wonderful. She was efficient, resourceful, and always in communication with us. We couldn’t have picked a better realtor.” – The Bellaus

Deciding if now is the right time to purchase a home involves several key factors. Buyers will want to consider the following:

Financial Stability: Ensure you have a steady income, manageable debt, and enough savings for upfront costs like a down payment and ongoing expenses like maintenance.

Interest Rates: Keep track of mortgage rates. When they’re low, home ownership becomes more affordable due to lower monthly payments. However, rates fluctuate, so it’s crucial to monitor trends.

Market Conditions: Understand your local real estate market, including home prices and inventory levels. In a seller’s market, where demand outweighs supply, prices may be higher, while a buyer’s market offers more negotiating power.

Long-Term Plans: Think about your future. Do you plan to stay in the area for a while? Will your housing needs change? Ensure home ownership aligns with your long-term goals.

Affordability: Evaluate if owning a home fits your budget, factoring in mortgage payments, taxes, insurance, and upkeep costs. Compare these expenses to renting to determine the best financial option.

Government Programs: Explore available programs and incentives for first-time buyers, like down payment assistance or tax credits, which can make buying a home more financially feasible.

Ultimately, the decision to buy hinges on your unique circumstances and aspirations. Take the time to assess your finances, research the market, and weigh the pros and cons before committing to home ownership.

Connect with a preferred lending professional and partner: https://www.grarate.com/loan-officers/emily-henson-1709154

Download free First Time Homebuyer Booklet https://www.rate.com/fthb-guide-download

Follow me on social media for more Real Estate information:

LinkedIn (64) Julia Montei | LinkedIn

Facebook http://www.facebook.com/juliamonteire

Website: Julia Montei (cbmoxi.com)

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link